CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

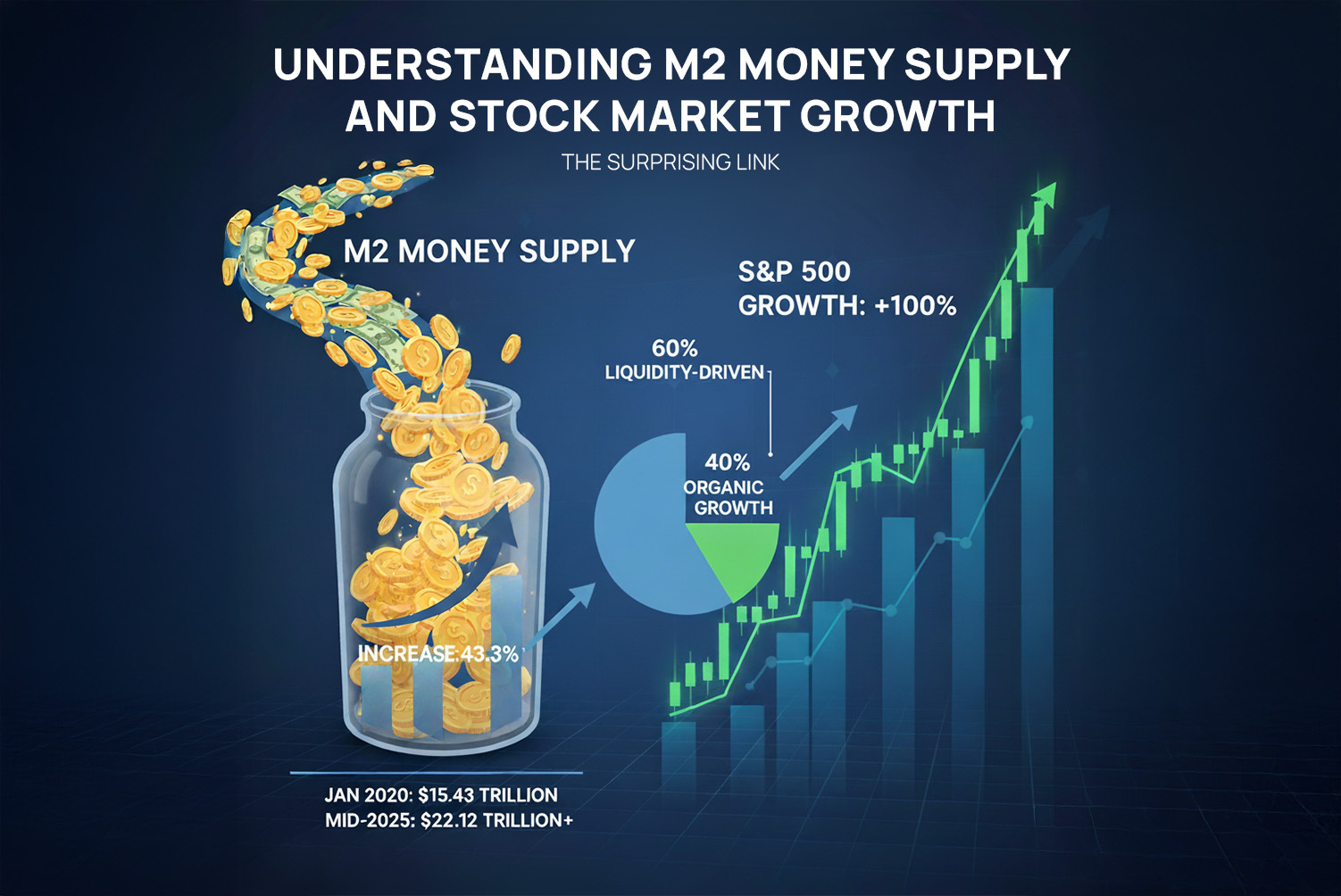

Understanding M2 Money Supply and Stock Market Growth

Let's kick off with a topic that’s fundamental to understanding the broader economy and its impact on asset performance:

The M2 money supply and its surprising link to stock market performance.

The United States' M2 money supply is essentially a measure of all the money flowing within the U.S. economy. Think of it as the total liquid cash, checking accounts, savings, and other easily accessible funds. Why is this important? Because when M2 expands, it often means more liquidity, more money looking for a home, and a significant portion of that money finds its way into assets like the stock market.

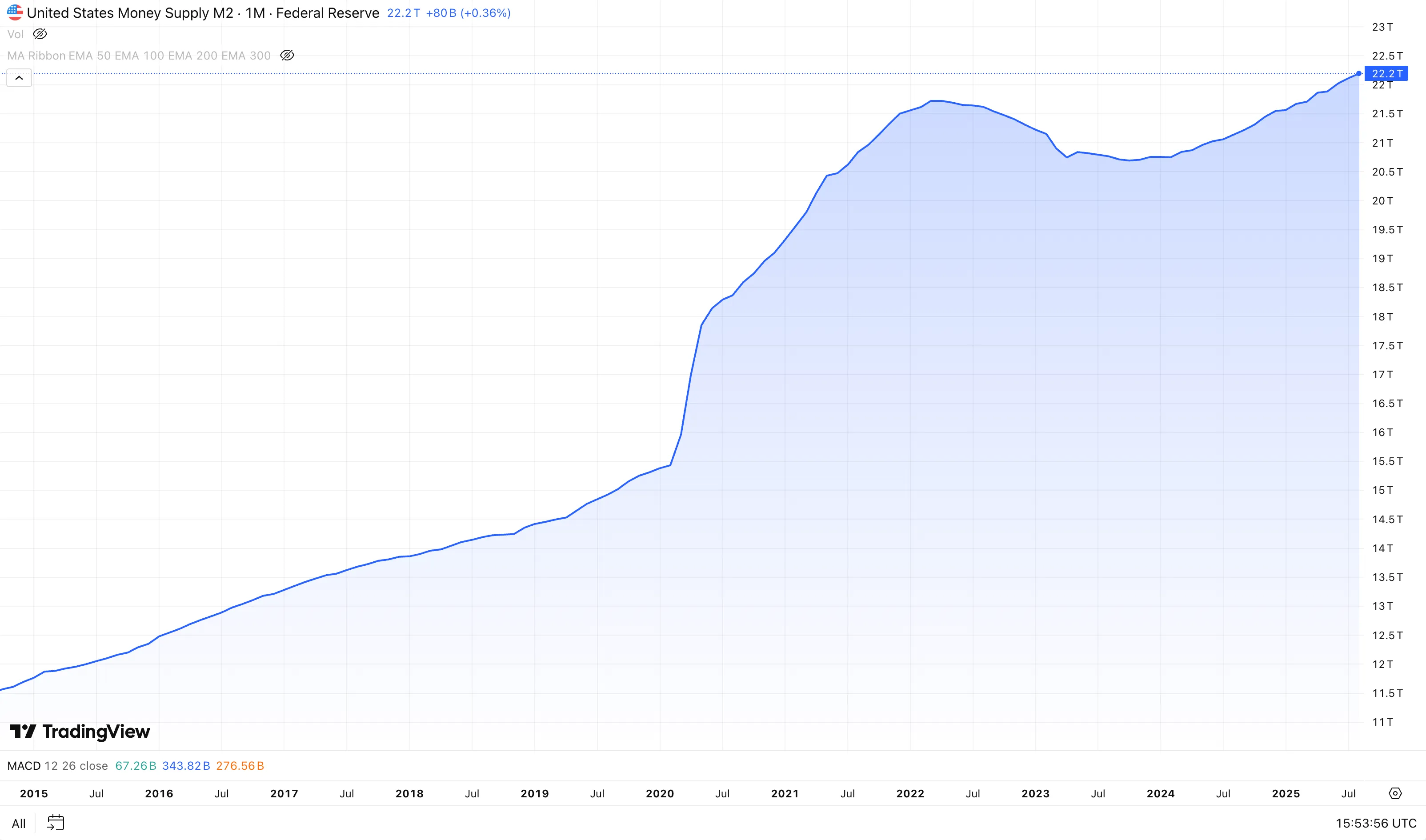

Since January 2020, just before the global pandemic hit, we've seen an unprecedented expansion in multiple M2's due to various stimulus measures. US M2 has grown from approximately $15.43 trillion to over $22.12 trillion by mid-2025 - a massive 43.3% increase. In the same period, the S&P 500, a key indicator of stock market health, has surged by over 100%.

So, the big question is: how much of this stock market growth is truly organic - driven by strong corporate earnings, technological innovation, and real economic expansion—and how much is simply due to this flood of new money inflating asset prices?

The internal analysis suggests something quite revealing: roughly 60% of the stock market's growth since early 2020 can be attributed to the expansion of the M2 money supply. This means that for every dollar the S&P 500 has gained, 60 cents of that gain might be due to increased liquidity rather than underlying economic fundamentals. The remaining 40% represents the organic growth we’d expect from a healthy economy.

This isn't to say the market isn't strong, but it highlights a crucial factor influencing valuations. The risks are clear: if M2 supply tightens, or if money velocity - how quickly money changes hands - declines, the market could face headwinds. This insight is vital for making informed financial decisions. Staying informed about these macroeconomic trends is key to protecting and growing your wealth.

Is a financial strategy based on business quality superior to the one based on a broad market money flow?

An investment strategy centered on business quality is generally considered superior to one based on broad market money flow, particularly in an environment of significant M2 money supply inflation. The influx of newly created money can distort market signals, leading to speculative bubbles in lower-quality assets that are simply riding the wave of excess liquidity. While a money flow strategy might yield short-term gains by following these trends, it carries substantial risk when the monetary stimulus wanes or market sentiment shifts. Conversely, high-quality businesses with strong pricing power, robust balance sheets, and durable competitive advantages are better positioned to navigate inflationary pressures. They can pass on rising costs to consumers, protecting their margins and intrinsic value over the long term, making a quality-focused approach a more resilient and fundamentally sound strategy.

For real-time updates and deeper dives, keep an eye on Federal Reserve releases and IUX blog section.

Share

Michal Kochanowski

Specializing in on-chain data analysis and market trends, with a background in decentralized finance (DeFi) research and development.